Making an investment in many futures

By Robert May

“It’s one thing to learn about investing.” Morgan Stanley President John Mack told a group of visiting ninth-grade students, “It’s another thing to actually do it.”

In 1999, about 35 students from nearby Martin Luther King Jr. High School were invited to participate in a guided tour of the Morgan Stanley headquarters in midtown Manhattan. At the end of the tour, the students were asked to deliver group presentations based on what they learned that day. During these presentations, Mack appeared, unannounced. He must have been impressed with what he heard because, after the students spoke, he urged them to start their own investment club. Then he wrote a check for $10,000 and handed it to the astonished faculty chaperones. That was the beginning of the MLK Investment Club; certainly the only New York City public high school investment club with a $10,000 endowment.

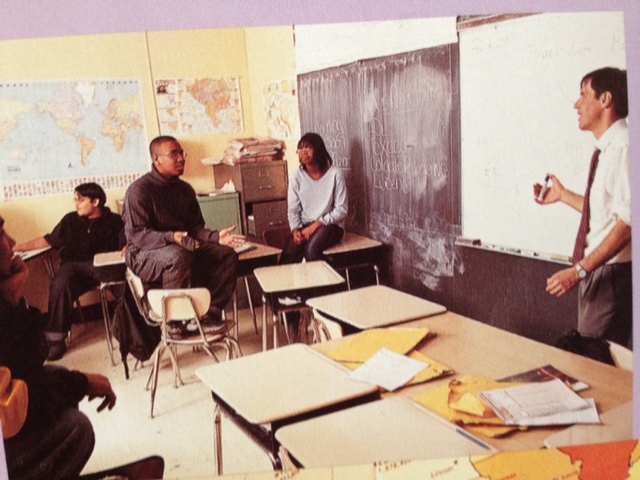

Investment Club meeting at MLK High School in NYC in 1999. Left to right: Preston Taylor, Monish Kinger, Michael Cooper, Christina Bogie, Robert May (faculty advisor)

“The students expressed a strong desire to learn more about finance and the corporate world.” Mack later explained. Learn they did. But some of the lessons were unexpectedly harsh. Soon after their initial foray into the stock market, members watched the share price of their newly acquired AOL stock plummet from $75 to $15. Lucent Technologies soon followed, collapsing from $18 to a paltry $6 per share.

“The tech stocks killed us.” one club member dryly reflected.

Even before their first investment, however, it was clear they needed an expert to guide them. Enter Joseph Bacchi, a financial analyst from Morgan Stanley in his early 30s, who had recently joined the firm. Joe volunteered to lead the weekly meetings, patiently guiding the club through its first halting steps. He invented an investment strategy that he called CMCM, which stands for: company, management, competition and market. Joe insisted that all four of these factors be researched by the young investors before any stock was considered for purchase. “I wanted to give them something easy to remember.” Bacchi recalled. It worked. Fifteen years later, his charges still remember the CMCM strategy.

A year after the club’s inception, the members were invited back to Mack’s office to give an accounting of their progress. They reported a 5 percent return to the president. Mack observed that the club had done better than many professionals during that time period.

Club member Preston Taylor presenting in 1999 in Mr. Mack's office, NYC. Left to right: Mr. John Mack, (then) President and Chief Operating Officer of Morgan Stanley, Christina Bogie, Monish Kinger, Preston Taylor and Araba Abaidoo

Without a doubt, this fortuitous introduction into the world of finance had a transforming effect upon the lives of the young investors. For example:

Charter member Michael Cooper, a native of Trinidad, arrived in New York with his mother and younger brother with no understanding of the workings of the stock market. Today, he is an investment advisor for Aya Capital.

The street gangs of New York City were the only groups Calvin Persaud had joined before becoming a member of the Investment Club. “I was a mess.” He recently conceded. Yet, he earned his investment and insurance licenses, worked as a small business banker for JP Morgan Chase and was ranked number three in sales in Georgia and Florida by the age of 27.

Because of an unstable family life, Christina Bogie left her home in the Bronx while still in high school, finding temporary living arrangements in her relatives’ apartments around the city. Years later, she claimed that one of the reasons she joined the Investment Club was to avoid her chaotic home life for as long as she could each day. She graduated from King High School in three years with honors and from Lehman College with an accounting degree. Today, she is an accountant for a medical complex in the Bronx.

When he was young, Ravi Raghunandan’s family fled their native Guyana because of the threat of persecution against citizens of Indian descent. They lived in the Bronx, seeking asylum here, while he attended high school and became a club regular. Now Raghunandan is a licensed real estate agent, selling Manhattan properties.

Eventually, the Bloomberg-era school closings forced the club out of King High School and, later, out of the High School of Graphic Communication Arts, another large midtown Manhattan high school where it was transplanted. But it survives.

Today, the original members are seeking a new home for their club in another high school. Understandably, the original members, now in their late 20s and early 30s have a solicitous interest in its continued success and are eager pass along the tradition to a new generation of students.

Over the last 15 years, the club has netted a modest profit from its portfolio, but the total return has been far greater than that. When John Mack gave $10,000 for stock investment, he was really investing in the lives of a handful of young men and women. By any index imaginable, his investment has been an unqualified success.

(Author Robert May is the faculty advisor of the Martin Luther King Jr. High School Investment Club and a member of the United Federation of Teachers.)